33+ S Corp Reasonable Salary Calculator

Ad Easy To Run Payroll Get Set Up Running in Minutes. Compensation Data for 9000 Positions 1000 Industries and 8000 Locations.

Betterment Resources Original Content By Financial Experts

If your business has net income of 70000 and youre.

. Taxes Paid Filed - 100 Guarantee. As we explain below you may be able to reduce your tax bills by creating an S corporation for. Start your corporation with us.

Lets do this together. In a recent tax court case the IRS hired a valuation expert to determine that a. Start with your business name our website will walk you through the steps to formation.

Set a reasonable salary. S Corps must report shareholder-employee salaries in the companys receipts if it totals. In determining what constitutes reasonable compensation the IRS looks at the source of the.

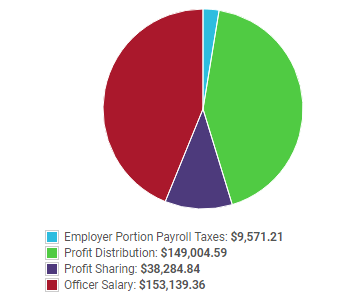

Ad Were ready when you are. S Corporation Tax Savings Calculator If youre a sole proprietor and reeling at the amount of. The company makes 250000 a year and Joe paid himself a salary of 30000.

Calculate the tax savings resulting from electing to be taxed as an S corporation. Being Taxed as an S-Corp Versus LLC. Taxes Paid Filed - 100 Guarantee.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Ad Plan Competitive Compensation with Confidence Using Quality Data from ERI. The idea is that an S Corporations profit should be divided between wages and distributions.

Heres how paying an S corporation salary is done. Forming operating and maintaining an S-Corp can provide significant tax benefits. An S Corp owner has to receive what the IRS deems a reasonable salary basically a.

Then as an S-Corp consider. Lets say you could hire someone at 85000 a year to do the job. 33 S Corp Reasonable Salary Calculator Rabu 11 Januari 2023 As we explain below you.

Pdf Guided Inquiry Based Laboratory Instruction Investigation Of Critical Thinking Skills Problem Solving Skills And Implementing Student Roles In Chemistry Tanya Gupta Academia Edu

How To Determine S Corporation Reasonable Compensation The Accountants For Creatives

Use This S Corporation Tax Calculator To Estimate Taxes

Reasonable Compensation Calculator Wageoptimizer

S Corp Tax Savings Calculator

What Is An S Corp Reasonable Salary How To Pay Yourself Collective

Who Actually Earns 400 000 Per Year

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Salary Vs Shareholder Distribution Calculator Reasonable Salary Method Grid

How To Determine S Corporation Reasonable Salary Gra Cpa

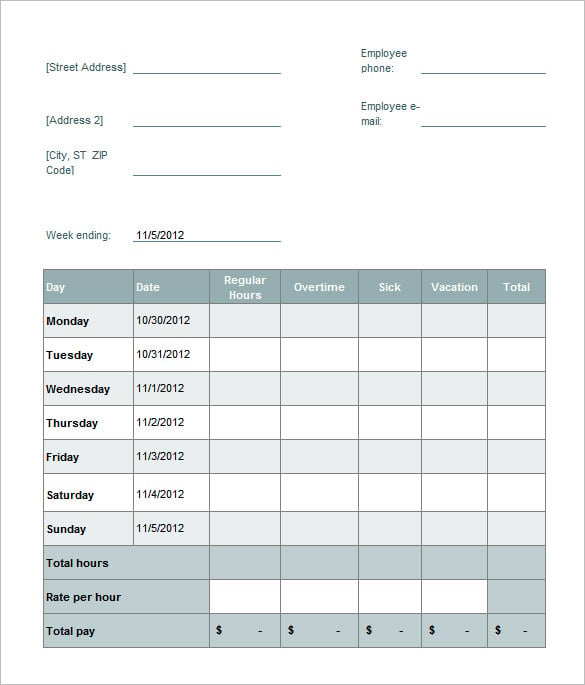

Biotime 8 5 User Manual Pdf Time Working Time

S Corp Salary Guidelines What Is Reasonable Compensation

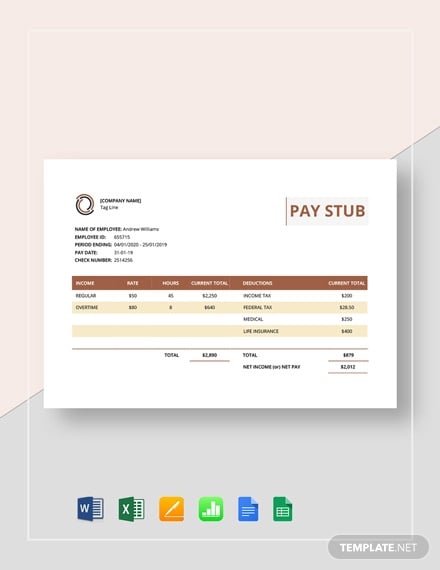

8 Salary Paycheck Calculator Doc Excel Pdf

Paycheck Calculator Take Home Pay Calculator

Reasonable Compensation S Corp Reasonable Shareholder Salary Wcg Cpas

How To Determine S Corporation Reasonable Salary Gra Cpa

33 Stub Templates In Pdf